|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

«ПерваяПредыдущая12345678910СледующаяПоследняя» |

||||||||||||||||||||||||||||||||||||||||||||||||||

| Страница 1 из 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Изготовление фасадных панелейИтак, мы уже определились с тем, что фасады, как таковые – это скучно, нудно, дорого и, вообще, нам ненужно, решив, что будем просто брать и делать сборно-разборные стенные плиты, которые ... Подробнее |

Фасадные панели-стены.К сожалению, разговор о панелях, призванных украшать фасады домов, а также об их установке, на данный момент времени и исходя и ныне распространенных в строительстве технологий – это общение на ... Подробнее |

Стеклянные фасадные панели.На весь корпус здания надевается еще одна оболочка, представляющая собой настоящую навесную стеклянную конструкцию. В этой оболочке обязательно предусмотрена вентиляция пространства, которое находится между навесной и несущей ... Подробнее |

Облицовочная новинка для стенНикто не станет отрицать, что в современном строительстве вентилируемый фасад – одно из лучших решений. При необходимости придания фасаду красивого практичного вида, будь то при строительстве или ремонте зданий, применение тако... Подробнее |

Преимущества вентилируемых фасадовНавесные фасады на сегодняшний день становятся все популярнее в строительстве. Обычно они применяются для офисных центров и административных зданий. Однако в последнее время навесные фасады очень нередки в жилищном строительстве. Какие же о... Подробнее |

Вентфасады. ПреимуществаВремя стандартизированных домов с фасадами ушло в прошлое. Теперь возникает необходимость решений, разнообразных по дизайну и техническим свойствам. Глубокое понимание вопроса о том, что понижение качества при новой стройке и реко... Подробнее |

Подготовительный этапПеред началом основных работ нужно провести подготовительный этап - обустроить строительную площадку в соответствии со строительным проектом. Необходимо установить ограждения, изолирующие людей от открытой рабочей зоны, обустроить тротуары, пешеходные галереи, ... Подробнее |

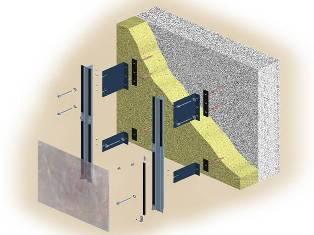

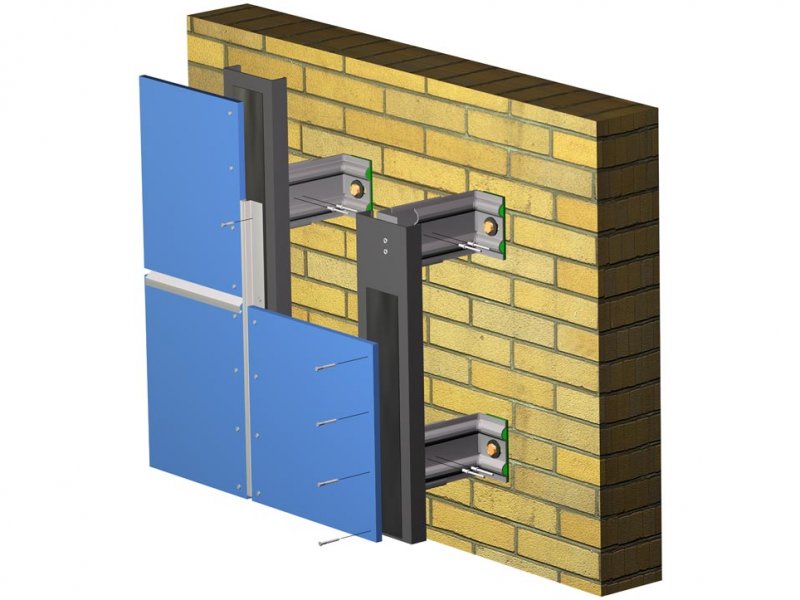

Монтаж кронштейнов подконструкцииПеред монтажом кронштейнов надо обследовать поверхности крепления конструкции, очистить фасад от отслоившейся штукатурки, потрескавшейся старой краски, демонтировать водостоки, вывески, антенны, различные кронштейны и ... Подробнее |

Монтаж несущих направляющихНесущие направляющие монтируются в соответствии с проектом. Сначала в закрепленный кронштейн устанавливают Т-образную вертикальную направляющую, а ее верхний конец фиксируют в стационарном ... Подробнее |

С теплоизоляцией жилищ, всё в целом несложно. Не считая того, что сейчас ввиду неразборности наших домов, а также из-за всё более дичающей алчности наших зодчих, этот вопрос решается совершенно неэффективным способом, типа: «сто одежек и все без застежек».

С теплоизоляцией жилищ, всё в целом несложно. Не считая того, что сейчас ввиду неразборности наших домов, а также из-за всё более дичающей алчности наших зодчих, этот вопрос решается совершенно неэффективным способом, типа: «сто одежек и все без застежек».

Как много в нашей жизни становится всего вентилируемого… При этом, проблема отсутствия качественно вентилируемых помещений, как была, так никуда и не делась.

Как много в нашей жизни становится всего вентилируемого… При этом, проблема отсутствия качественно вентилируемых помещений, как была, так никуда и не делась.

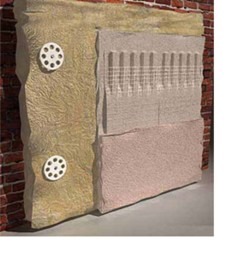

Предусмотренное конструкцией наличие воздушной прослойки обуславливает принципиальное отличие вентилируемой фасадной системы от фасадов других типов. Основное назначение воздушного канала - вентиляция подоблицовочного пространства, где обычно бывает слишком тепло и влажно. Из-за разности температур и перепада давлений в образуемом вентиляционном коридоре начинает работать принцип вытяжной трубы.

Предусмотренное конструкцией наличие воздушной прослойки обуславливает принципиальное отличие вентилируемой фасадной системы от фасадов других типов. Основное назначение воздушного канала - вентиляция подоблицовочного пространства, где обычно бывает слишком тепло и влажно. Из-за разности температур и перепада давлений в образуемом вентиляционном коридоре начинает работать принцип вытяжной трубы. Предусмотренное конструкцией наличие воздушной прослойки обуславливает принципиальное отличие вентилируемой фасадной системы от фасадов других типов. Основное назначение воздушного канала - вентиляция подоблицовочного пространства, где обычно бывает слишком тепло и влажно.

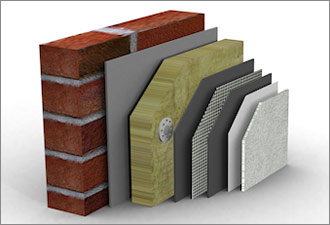

Предусмотренное конструкцией наличие воздушной прослойки обуславливает принципиальное отличие вентилируемой фасадной системы от фасадов других типов. Основное назначение воздушного канала - вентиляция подоблицовочного пространства, где обычно бывает слишком тепло и влажно. Около 40% тепловых потерь здания приходится на его фасад, или наружные стены. Существует несколько типов теплоизоляционных систем для фасадов: системы с вентиляционным зазором, сэндвич-панели, "колодезная кладка", светопрозрачные системы, "мокрые" фасады (системы с тонким штукатурным слоем). Cистема "мокрых" фасадов состоит из минерального утеплителя

Около 40% тепловых потерь здания приходится на его фасад, или наружные стены. Существует несколько типов теплоизоляционных систем для фасадов: системы с вентиляционным зазором, сэндвич-панели, "колодезная кладка", светопрозрачные системы, "мокрые" фасады (системы с тонким штукатурным слоем). Cистема "мокрых" фасадов состоит из минерального утеплителя